👋 Hey hey,

This is The Chain, where we take the good, the bad, and the ugly in crypto and present it in the most enjoyable way we can… through the eyes of Twitter narratives.

Here are this week's highlights:

🤯 Trump-China Spat Destroys Crypto; Binance to Blame?

💧 Hyperliquid Got an Extremely Interesting Upgrade

🦖 Dino Coins Have Their Day in the Sun

⚡ Plasma Took the Stablecoin Industry by STORM!

It’s been a strange week with some potential scammage happening, but overall, things seem to be all good in the crypto neighborhood.

We’ll cover the brutal stuff first and the exciting stuff after.

Let’s get into it.

In partnership with CoW Swap

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Please support our partners!

🤯 Binance Accused of Foul Play in Trump-China Tariff Crypto Wipeout

So much has happened since last week.

Friday (last week): China announces restrictions on rare earths exports to the US, which are key for the US’s semiconductor chips.

Trump fires back immediately with threats of 100% tariffs on China.

Bitcoin dropped to $105K and Ethereum lost 22%

Altcoins: Sui lost 70%, Solana was down 45%, Avax dropped 27%

$19.13B in leveraged long positions were liquidated

1.6 million accounts were wiped out entirely

Why Traders Are So Mad at Binance

Several things happened over on Binance’s exchange that ticked people off; some of the events have clear explanations, but some, not so much… 🧐

Binance’s ADL (auto-deleveraging) kicked in, meaning that even traders with winning positions were liquidated to cover for the sheer amount of losing traders

Ethena’s USDe stablecoin depegged, going all the way down to $0.65 on Binance

Binance has issued $283M to repay users affected by the depegging of USDe and some other assets

The craziest one of all: some analysts are accusing Binance and market maker Wintermute of engineering the crash themselves.

The reasoning for the alleged plot to crash the crypto market? Flushing out leverage on Binance and Wintermute to clean their books out.

The evidence?

Wintermute allegedly moved $700M to Binance a few hours before the crash. (People are likely interpreting this as “Wintermute was dumping its BTC on Binance!”)

And then BTC’s price dropped to $105K.

There’s no proof, just on-chain detectives and theories. The only thing we know for certain is that a total of $500B in crypto value was wiped off the face of the earth in this crash.

In partnership with Consensus2026

Crypto’s Most Influential Event

This May, Consensus will welcome 20,000 to Miami for America’s largest conference for crypto, Web3, & AI.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus is your best bet to market-moving intel, get deals done, & party with purpose.

Ready to invest in your future?

Secure your spot today.

Please support our partners!

💧 Did Hyperliquid… Just Get Even More Momentum?

So the decentralized perps exchange everyone has been talking about all year just got a serious upgrade.

The short of it is that anyone can now launch perps contracts on Hyperliquid.

Meaning?

You can make a perps contract for any token to trade it with leverage on Hyperliquid now.

All you need is $19.3M to qualify for launching your own perpetuals contract.

Anyone got a spare $20 milly lying around?

The HIP-3 upgrade allows permissionless perps creation for anyone with 500,000 HYPE staked on the blockchain.

This upgrade came just the day after $10B was wiped out on Hyperliquid by the Trump-China disaster we mentioned above.

🦖 Zcash (ZEC) Rose 520% in Just 19 Days

The crypto privacy narrative seems to be getting its day in the sun after years of trading at weirdly low prices.

Over the course of 19 days, ZEC silenced the haters (and people that just forgot it existed) by posting 520% gains, rising from $47.6 to $295.24. That’s the highest it’s been since May of 2021.

It’s funny, privacy has been widely agreed upon to be one of crypto’s strongest narratives for a long time, but ZEC just hasn’t gotten the love it deserves over the years. Looks like that could be changing.

Old cryptocurrencies like Zcash and DASH are making XRP-like runs, causing some traders to call this “Dino coin season.” I’m here for it.

DASH posted almost 200% gains in a similar timeframe.

⚡ Not Donating Plasma. Trading On Plasma.

The stablecoin narrative has been front and center this year as US regulators have provided more and more clarity on what’s ok and not ok. The industry is honestly popping off.

Enter Plasma. It’s a new layer 1 blockchain (backed by Peter Thiel) that just launched about three weeks ago. It had a seven-times oversubscribed initial coin offering where it raised $373 million.

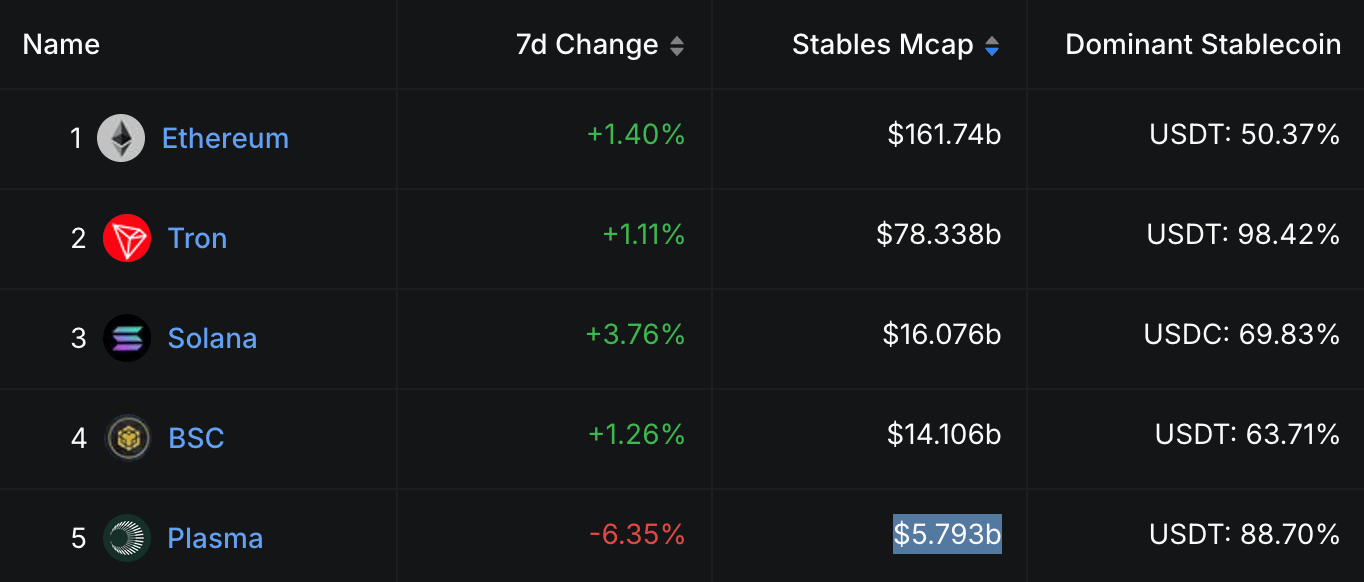

And after just 3 weeks, Plasma is now the number 5 chain in terms of total stablecoin market cap ($5.793b):

But stablecoins aren’t all Plasma has.

After it reached “Mainnet Beta” toward the end of September, Plasma became memecoin-enabled. Of course, manic trading ensued.

A standout was “Trillions,” a memecoin named in reference to Plasma’s belief that the stablecoin total market cap will reach trillions of dollars.

As the line between neo-banks and stablecoin platforms becomes increasingly blurred, it’s increasingly clear to us: global adoption is real, and it’s here.

🍟 Extra Crispy Crypto Links

Have you gotten a “Bitcoin Steakburger” from Steak ‘n Shake yet? The burger was launched in celebration of 5 months of accepting BTC as payment.

The Chinese megacorp behind Alipay just launched an Ethereum layer 2, potentially bringing 1.4 billion users to the network.

The Solana liquid staking protocol Jito just raised $50M from Andreessen Horowitz (a16z).

Eric Trump says his family has made over a billion dollars from crypto at this point in time.

Blackrock’s CEO was pushing pro-crypto messaging this week, saying that tokenized ETFs are “the next wave of opportunity for BlackRock.”

📩 Weekly Meme Delivery

🎤 Let us know what you thought

We really appreciate you reading our newsletter, and we’d love to hear your feedback.

How was this week's edition?

⏳ Wrapping Up

It’s a wild time to be in crypto. Global tariff wars, market manipulation conspiracy theories, and perp dexes. Perp dexes everywhere.

But honestly when has it NOT been a crazy time to be in crypto? In fact, this is likely one of the less crazy times to be in the industry because of all the recognition and adoption its seen.

So don’t freak out. Price may go up and price may go down, but at least we don’t have to worry about everyone forgetting Bitcoin tomorrow.

Same time next week? Sounds good.

Until next time,

- The Chain Team

The information provided in The Chain is for informational and educational purposes only and should not be construed as financial advice, investment advice, or a recommendation to buy or sell any securities. The Chain is not a registered investment advisor, broker-dealer, or licensed financial planner. Always do your own research and consult with a licensed financial advisor before making any investment decisions. We may hold positions in or receive compensation from the companies or products mentioned. Disclosures will be made where applicable.

The Chain, Stocks & Income, AltIndex, Finance Wrapped, and Future Funders are all owned by Invested, Inc.