Greetings, Crypto Climbers👋,

Imagine this: a Wall Street powerhouse, a tech giant, and a stablecoin titan team up in a bold $3 billion crypto move. Yes, this happened in the past week.

A big move is in play right now. Many experts are now wondering has time came for crypto’s to shine again.

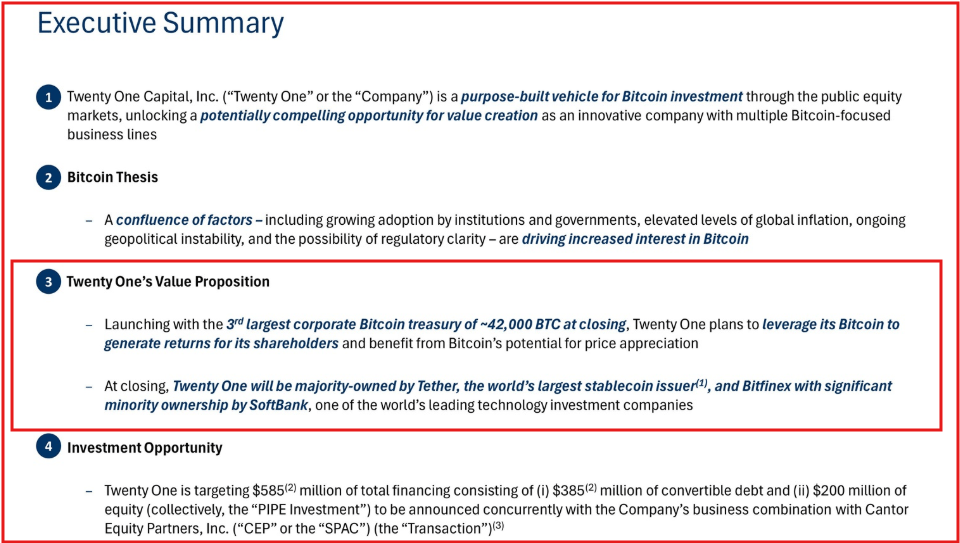

All this began when in late April 2025, Cantor Fitzgerald, under CEO Brandon Lutnick, unveiled a landmark plan. Together with SoftBank, Tether, and Bitfinex, they’re launching 21 Capital. This is a Bitcoin-focused investment vehicle designed to reshape crypto finance.

According to recent SEC filings, they plan to raise $350 million via convertible bonds and another $200 million through private equity placements. Their endgame? Mirror MicroStrategy’s Bitcoin accumulation strategy.

👉 What’s your first instinct - bullish innovation or risky overreach? Hit reply and share your gut reaction!

🔍 Why This Matters: A Bold Bid for Bitcoin Dominance

Cantor’s move is anything but casual. It signals that Bitcoin isn’t just a speculative asset anymore - it's becoming Wall Street’s battleground.

Zooming out, Cantor Fitzgerald isn’t new to headline-grabbing deals.

They recently completed a $470 million Opportunity Zone Fund with Silverstein Properties and backed Soulpower Acquisition Corp.'s $250 million IPO.

Yet, this $3 billion Bitcoin play feels different.

It’s bigger. Riskier. And potentially transformative.

Clearly, this isn’t about riding short-term hype. It’s a strategic shift, as it is positioning Bitcoin as a core institutional asset alongside traditional holdings.

🦾Breaking Down the Big Players: Why It’s Not Just About Cantor

The names involved matter.

SoftBank, one of the biggest venture capital firms globally.

Tether, operator of the world’s largest stablecoin, USDT.

Bitfinex, a heavyweight exchange platform.

This trio brings deep liquidity, financial muscle, and operational expertise.

Their involvement suggests that 21 Capital isn’t some moonshot experiment - it’s a serious institutional effort.

Nevertheless, challenges loom. Crypto regulation remains complex. Bitcoin’s price volatility is legendary.

And while institutional adoption grows, skepticism among traditional investors lingers.

🛑 Risks on the Radar: This Bet Isn’t Without Consequences

As last week highlighted in bitwise report, despite of on-chain and fundamental supporting BTC price, in entire Q1 of 2025 it fell and gave a rough ride for investors. Bitwise has optimism for Q2 2025 to be charming enough for investors.

However, Let’s not ignore the elephant in the room; that is risk.

Cantor’s SEC filing acknowledges several red flags:

Regulatory clampdowns could derail or delay operations.

Bitcoin volatility could decimate fund valuations overnight.

Custody risks persist, even with institutional-grade infrastructure.

Moreover, there’s reputational risk. If Bitcoin price falters again like in Q1 2025, or if the fund underperforms, it could tarnish Cantor’s growing reputation in the digital asset world.

Meanwhile, with SoftBank and Tether involved, questions about transparency and governance will inevitably arise from critics.

📩 Do you feel better when big traditional firms invest in crypto - or does it make you worry about over-centralization? Tell us what you think!

📈 Potential Outcomes: Big Boom or Slow Burn?

If 21 Capital succeeds:

It could draw billions more into Bitcoin from cautious institutional investors.

It would strengthen Bitcoin’s reputation as a legitimate, long-term store of value.

And, it might encourage even bigger players to make similar moves.

On the other hand, after creating this hype if this fund stumbles:

It could reinforce fears that Bitcoin remains too risky for mainstream portfolios.

It might trigger short-term volatility, shaking weaker hands out of the market.

Worse, it could sour Wall Street’s love affair with digital assets.

For now, the crypto community waits - cautiously optimistic but fully aware of the stakes.

📩 Final Thoughts:

Cantor Fitzgerald’s $3 billion bet isn’t just a flex.

It’s a loud signal that crypto markets are maturing - but growing pains are inevitable.

As Wall Street gets serious about Bitcoin, two paths emerge:

One where crypto gains broader legitimacy and another where growing complexity demands sharper strategy from every player.

No matter which way the market turns next, one thing’s certain:

The future of finance is being written right now in Bitcoin.

Stay sharp, stay informed, climber’s.

We’ll be tracking Q2 week by week - and as always, decoding the signal from the noise.

Until next time,

From FOMOchain Team.