Greetings, Readers👋,

GM. This is FOMOchain, the newsletter helping you to maintain the title of ‘crypto big-brain’ among your friends.

Here’re the quick highlights from the week:

🏛️White House Offers Crypto Clarity (Finally)

🧠SEC’s Options Shift Supercharges BlackRock’s ETF

🛠️Cardano Goes Big With $71M Roadmap Approval

🐳Ethereum Whales Are Back: $1.65B and Counting

🔄Reshoring Crypto: The US Wants Builders Back

🔐Solv Protocol Targets $1T in Dormant BTC with Yield Vaults

Let’s unpack the regulatory reboot, crypto firm strategies, whale-sized ETH buys, and what it all might mean for your portfolio.

This crypto newsletter is proudly sponsored by “Pacaso“.

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

🏛️ White House Offers Crypto Clarity (Finally)

After years of grey zones and agency turf wars, the White House’s Working Group on Digital Assets has released its crypto policy report.

Key takeaways?

The SEC will continue to regulate securities, while the CFTC gains spot market oversight.

Stablecoin use will be part of dollar-strengthening strategies.

A unified market structure is in sight, finally.

📌 Why it matters: Clearer rules allow crypto firms to build with confidence. Instead of courts deciding who’s in charge, regulators now have lanes to stick to.

🧠 Do you think the CFTC will handle crypto markets better than the SEC? Hit reply-we want to hear your take.

🧠 SEC’s Options Shift Supercharges BlackRock’s ETF

In what might feel like a small technical tweak, the SEC just raised the options cap for ETFs-from 25K to 250K contracts. This applies to ETFs like BlackRock’s iShares Bitcoin Trust (IBIT).

Why this matters:

IBIT already dominates with $85.5B AUM-4x its closest rival.

The options cap gives institutions more flexibility to hedge or speculate.

More demand for options can reduce spot volatility and increase institutional flows.

📊 It’s a feedback loop: Less volatility = more allocation = more demand.

This policy adjustment might quietly give the green light for Bitcoin ETFs to operate more like traditional financial products-and that’s a big step for mainstream adoption.

🧠 Would you trade options on a Bitcoin ETF? Let us know how you’re thinking about this.

🛠️ Cardano Goes Big With $71M Roadmap Approval

Cardano’s community just voted overwhelmingly to approve a 12-month development plan worth 96 million ADA (~$71M).

Network scalability

Developer tools

Interoperability

🧾 The vote passed with 74% approval, though not without some concern over accountability and cost transparency.

📌 This marks a serious commitment from the ecosystem toward long-term innovation, positioning Cardano to compete harder in the Layer 1 race.

💬 “From roadmap to reality” might be more than a slogan this time.

🐳 Ethereum Whales Are Back: $1.65B and Counting

SharpLink is going deep on $ETH. The firm has purchased over 30,000 ETH in just 48 hours, totaling $108.5 million. Their current holdings? 480,031 ETH-worth $1.65B.

This is no accident.

💡 Most of this was bought around the $3,530 mark, including one $23M transfer. Even more interestingly, data shows whales across Hyperliquid are long on ETH.

Meanwhile, ETH price charts show a sharp bounce from August 3rd lows. Now, ETH is climbing back.

💬 Smart money is buying the dip-quietly, but aggressively.

🧠 Are you following the whales or fading the pump? Share your ETH strategy with us.

🔄 Reshoring Crypto: The US Wants Builders Back

In a surprising shift of tone, SEC Chair Paul Atkins called on crypto companies to return to the U.S.

“We’re in the golden age of crypto,” added Treasury Secretary Scott Bessent, inviting founders to launch their protocols and hire locally.

Companies like Kraken and MoonPay are already responding by expanding stateside operations.

🚨 The narrative is changing. After months of clampdowns, the U.S. is signaling: “Come build here.”

🧠 If you were an crypto startup would you have preferred to relocate to the U.S. under this new regulatory environment?

🔐 Solv Protocol Targets $1T in Dormant BTC with Yield Vaults

Solv Protocol launched BTC+, a new structured yield vault built to unlock yield on idle Bitcoin.

It’s designed for institutions, with a dual-layer architecture and Chainlink’s Proof-of-Reserves for transparency.

What it offers:

Yields via CeFi, DeFi, and TradFi strategies.

Integration with real-world asset funds like BlackRock’s BUIDL.

Target: The $1 trillion+ in BTC sitting idle.

🧠 With Coinbase and XBTO already in the yield game, Bitcoin is quickly evolving beyond a “hold-only” asset.

📌 This could reshape how institutional portfolios view BTC-not just as digital gold, but as an income-generating instrument.

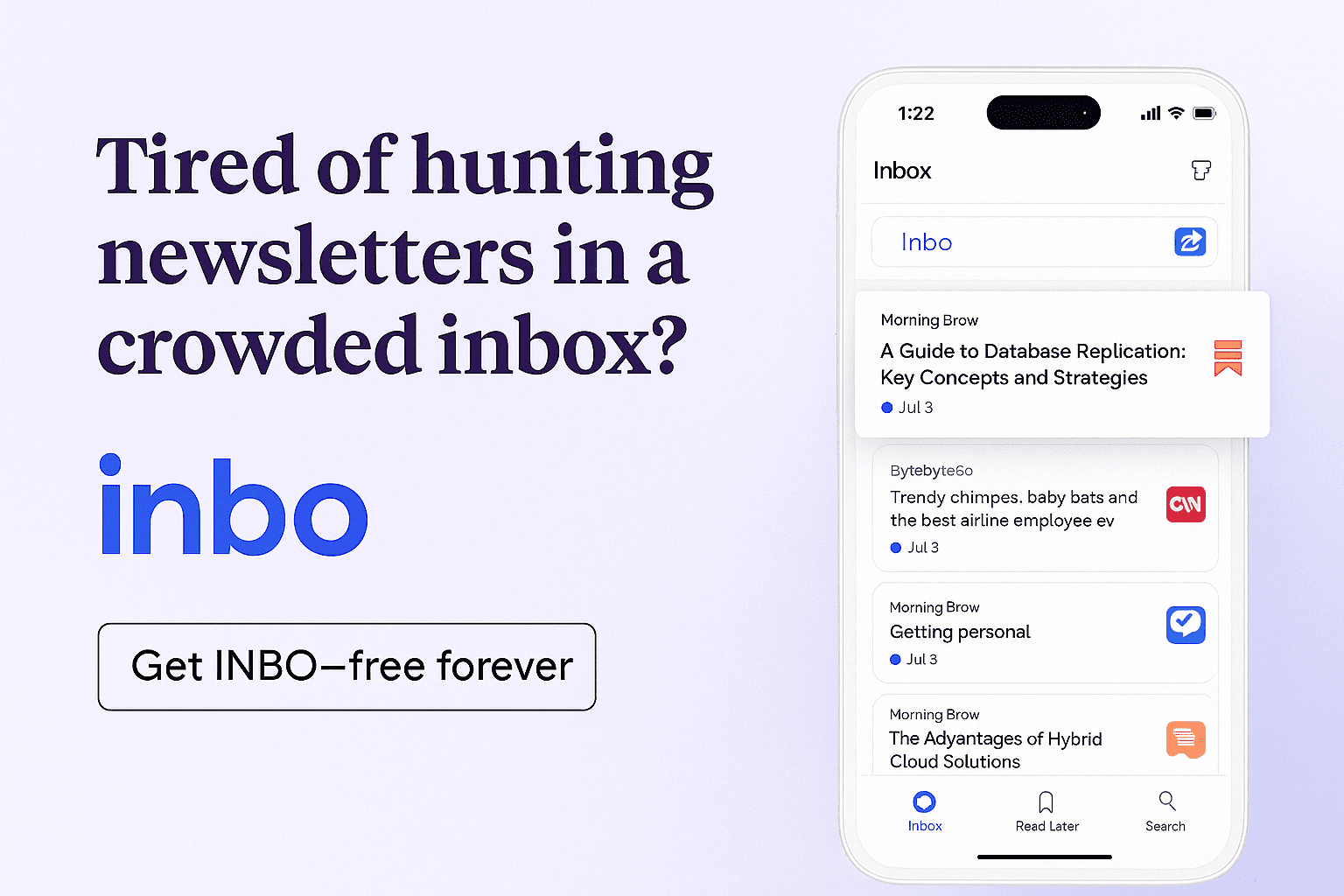

✨ "We are powered by INBO - your dedicated inbox for favorite newsletters, ensuring they never get lost in the crypto chaos!"

Your favorite newsletters arrive mixed with work emails, promotions, and notifications. By the time you have a moment to read, they're buried 50 emails deep.

INBO solves this with intentional design.

A calm, dedicated inbox where newsletters wait patiently for your attention, not competing with urgent messages or promotional noise.

Your reading time deserves better than email chaos.

📣click here to get a dedicated newsletter home:

Quick Hits

🇸🇻 El Salvador's President Bukele can now run for office indefinitely after a major constitutional reform. His influence on crypto policy just became more durable.

🧵 Andreessen Horowitz warns the CLARITY Act could have loopholes that undermine protections. They’re asking the Senate to rethink before finalizing.

Thanks for reading FOMOchain’s crypto dive.

Stay tuned, Reader’s.

We’ll be tracking Q2 week by week - and as always, decoding the signal from the noise.

Until next time,

From FOMOchain Team.