Hey there.

It’s The Chain, where we’re just like any good Disney Princess. We don’t let our pasts define us.

And in crypto, the past looks like 4-year cycles and BTC + Layer 1s = good investments.

Things aren’t so simple any more. So we’re asking the question: What are the most promising narratives of 2026 in crypto?

Today:

🤖 Really? AI, even here?!

🌎 Welcome to the real world (assets)

🪙 Just stay stable, alright

Check it out 👇

This newsletter is for informational and entertainment purposes only. It’s not financial advice. Past performance doesn't guarantee future results. Crypto is risky. Always do your own research (DYOR) and never invest more than you can afford to lose. [Full disclaimer below]

In partnership with Alts.co

These guys go way beyond stocks and bonds

Alts is the go-to newsletter for investors who are tired of the same public market ideas.

Each week, Stefan and Wyatt surface real opportunities in overlooked asset classes — from tequila barrels, to K-Pop music rights, to film financing bridge loans.

This isn’t just a newsletter though. They create special purpose vehicles (SPVs) so you can invest directly into each deal alongside the community.

If you’re an accredited investor, Join 135,000 subscribers and see what you’ve been missing.

Please support our partners!

The Top 3 Crypto Narratives of 2026 (So Far)

We’re all of 8 days into the year, but already, some things are pretty clear:

The 4-year cycle is either dead or out to lunch

Everything is AI, and AI touches everything

AI agents are here and are improving

Stablecoins (Neo-banks) are CRUSHING it

There’s still money in crypto

What do those things mean? We think it means that this year will look different from last year. Far different.

And although you might recognize some names and terms below, the cases for these top 3 narratives have never looked quite like this before.

So come forget the past with us like a Disney Princess and take a look at what the future might hold:

1. Crypto Is the Currency of AI Agents

Remember all the AI coins in 2024? And how they were all trash?

Us too. In 2026, the idea isn’t “AI coins” though, it’s “agentic commerce.” And it’s totally different.

The idea here, according to Forbes, is that soon, AI agents will be transacting for us. In fact, they’ll be transacting with one another. And they will need an internet-native currency to do that. Sounds like crypto, but which crypto?

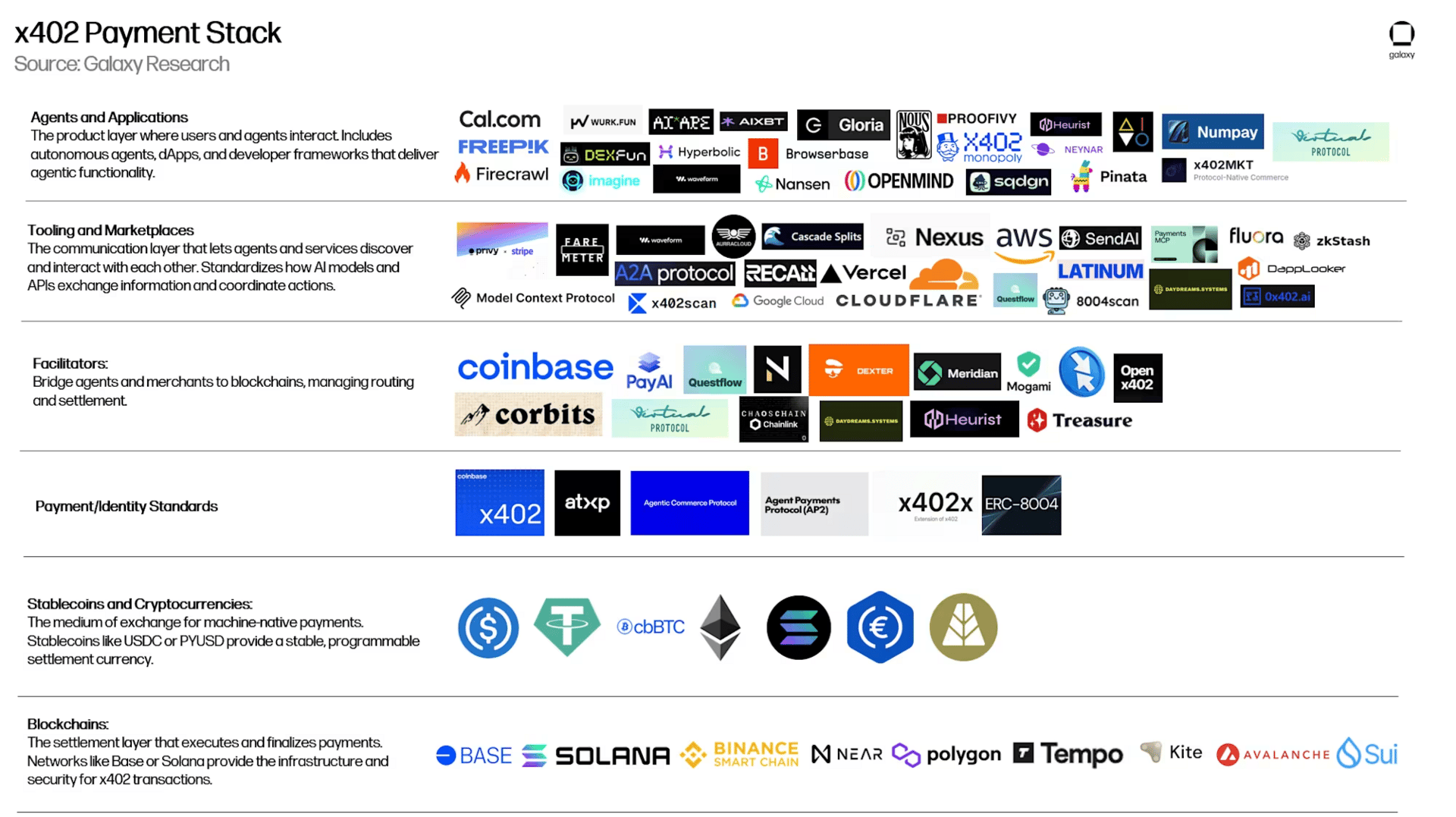

Well, have you heard of x402? It’s a new crypto payment standard, and it’s one of the top picks for which type of token will be the go-to option for AI agents to transact with. It’s short for “HTTP 402 Payment Required,” according to Galaxy Digital.

And which companies are in on the x402 development stack?

All of these:

Image credit: Galaxy Digital

And if you want to look deeper into the x402 world, check these resources:

2. RWAs Are Back and Better Than Ever?

This one’s pretty interesting. At first, RWAs (real-world assets) were all like “Hey, we’ll put your pet rock on-chain! And maybe we’ll tokenize a house in New York and see if people buy shares on our creepy crypto app??”

But in 2025 they became all about tokenizing Treasury bills. (See BlackRock’s BUIDL, their first tokenized fund.)

And now, the RWA field might be widening to cover private credit, (legitimate) real estate, and “equity perps” (think trading tokenized stocks 24/7 instead of during trading hours).

Here are some of the biggest players to keep an eye on:

Ondo Finance $ONDO

Centrifuge ($CFG)

Chainlink ($LINK) as the data bridge

3. Stablecoins Are Still On Top (Never Left)

Stablecoins did an estimated $9T in transaction volume (adjusted) last year. That’s ~5x the volume of PayPal, and almost half the volume of VISA.

As one of the first crypto products to find true product-market fit, stablecoins have already built quite a reputation for themselves in the world of finance. And after the passing of the GENIUS Act late last year, more and more banks are using them.

We think the stablecoin industry will continue to grow at a breakneck pace throughout 2026 as well.

The projects and companyies we’re interested in?

Circle (CRCL), which has a buy rating on AltIndex

PayPal (PYPL, PYUSD)

Ethena (ENA)

And that’s a wrap on the top 3 narratives we see coming in 2026.

🍟 Extra Crispy Crypto Links

Zcash’s (ZEC) developer team just resigned, tanking the token’s value by 19%.

Bank of America just upgraded their Coinbase (COIN) rating to a “buy”.

The South Korean Supreme Court can now seize Bitcoin that’s on exchanges.

Florida lawmakers are considering a state Bitcoin reserve.

Arthur Hayes thinks the US’s actions in Venezuela could push BTC to $200K.

📩 Weekly Meme Delivery

🎤 Let us know what you thought

We really appreciate you reading our newsletter, and we’d love to hear your feedback.

How was this week's edition?

⏳ Wrapping Up

Hope the start of 2026 has been a good one for you. We know it’s been fun for us! Markets are so lively right now.

Are there any narratives you think will blow up in 2026 that we didn’t cover? Reply and let us know!

Same time next week? Sounds good.

Until next time,

- The Chain Team

This newsletter is provided for informational and entertainment purposes only and does not constitute financial, investment, legal, or tax advice. Nothing in The Chain should be construed as a recommendation to buy, sell, or hold any cryptocurrency, stock, or other financial instrument.

Past performance does not guarantee future results. Cryptocurrency and stock investments carry substantial risk, including the potential loss of principal. Digital asset markets are highly volatile and speculative in nature. You should never invest more than you can afford to lose.

The authors and publishers of The Chain may hold positions in cryptocurrencies, stocks, and other assets discussed in this newsletter. We are not registered financial advisors, brokers, dealers, or investment professionals. The information presented is based on publicly available sources and personal opinions, which may contain errors or become outdated.

Always do your own research (DYOR) and consult with qualified financial, legal, and tax professionals before making any investment decisions.

The Chain, its authors, and publishers assume no liability for any losses, damages, or adverse outcomes resulting from reliance on information contained in this newsletter or from any investment decisions made based on its content.

Sponsored Content Disclosure: This newsletter contains paid partnerships and sponsored content. Sponsors have paid for placement.