Greetings, Crypto Hodler’s 👋,

The 2025 began with high hopes and even higher expectations in the crypto world. In this world, Cardano and Ethereum, two blockchain powerhouses, rolled out what each called their biggest upgrade in history that is Plomin and Pectra, respectively.

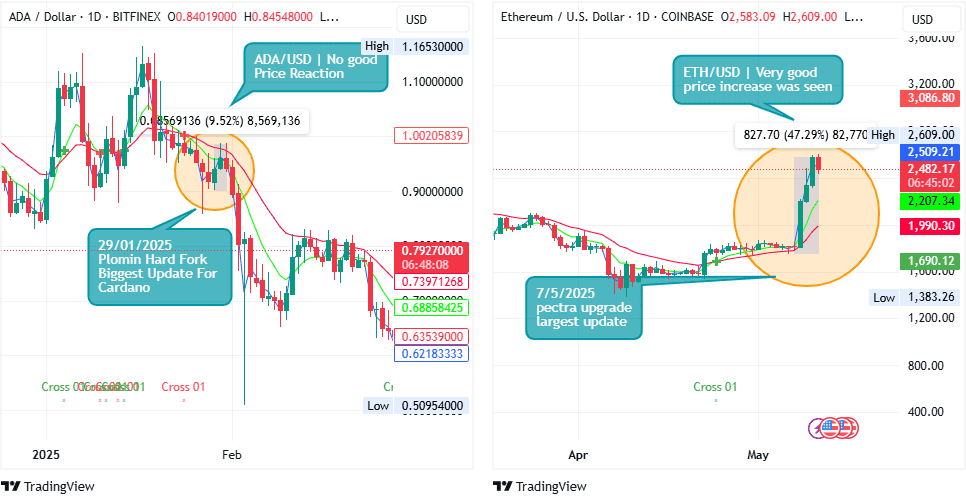

ADA/USD & ETH/USD 1.D. | Source: TradingView

But while one of them saw its price skyrocket nearly 50%, the other barely managed a modest 10% bump before slipping back. What went wrong with ADA, and what went right with ETH?

Let’s break it down.

The Plomin Upgrade: Governance Revolution for Cardano

On January 29, 2025, Cardano executed the Plomin hard fork, which is a historic moment for the chain. Before this, Cardano’s governance was handled mainly by its founding organizations: IOG, Emurgo, and others.

This raised concerns. Too much centralization. Too little community involvement. The network needed a shake-up.

Enter CIP-1694, known as a Cardano Improvement Proposal that redefined governance. It laid the foundation for on-chain voting, introduced DReps (Delegated Representatives), and empowered the ADA community through a constitution.

So, why didn’t the price explode?

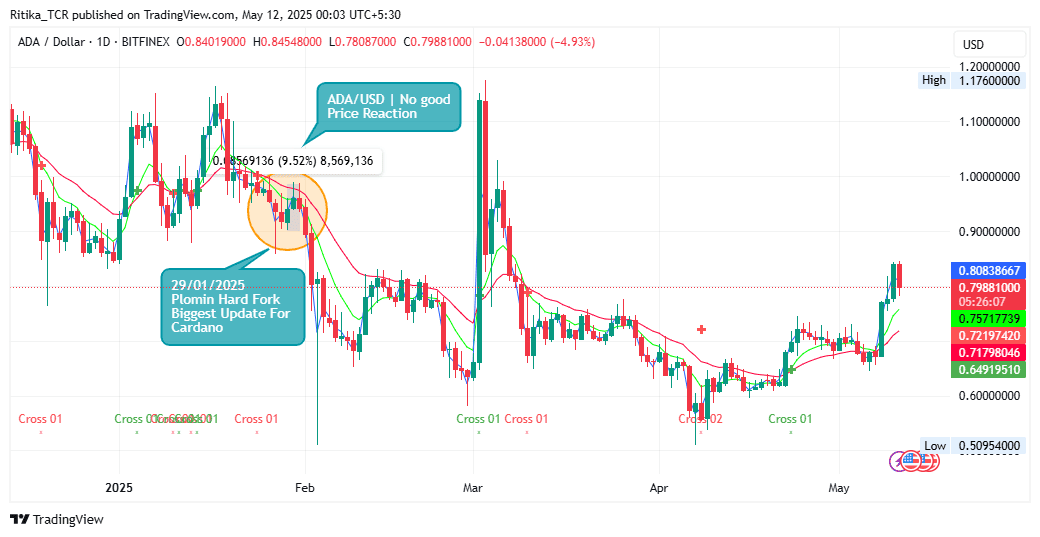

Despite the magnitude of the upgrade, ADA’s price rose less than 10% on the daily chart. Most traders expected fireworks. Instead, days later the market gave a muted nod.

Why? Timing.

The Trump Tariff Shock

By early February, word spread fast: The Trump administration planned to impose major tariffs. Though specifics weren’t released, the damage was done. Negative sentiment flooded crypto forums and social media.

ADA couldn’t catch a break.

Volatility gripped the market. S&P 500 took a hit. Bitcoin tumbled. And ADA, despite its upgrade, slid lower amid the chaos.

ADA/USD 1.D. | Source: TradingView

The community-driven governance overhaul was substantial, but still markets don’t move solely on fundamentals. Sentiment matters. Timing matters more.

Ethereum's Pectra: Right Upgrade, Right Time

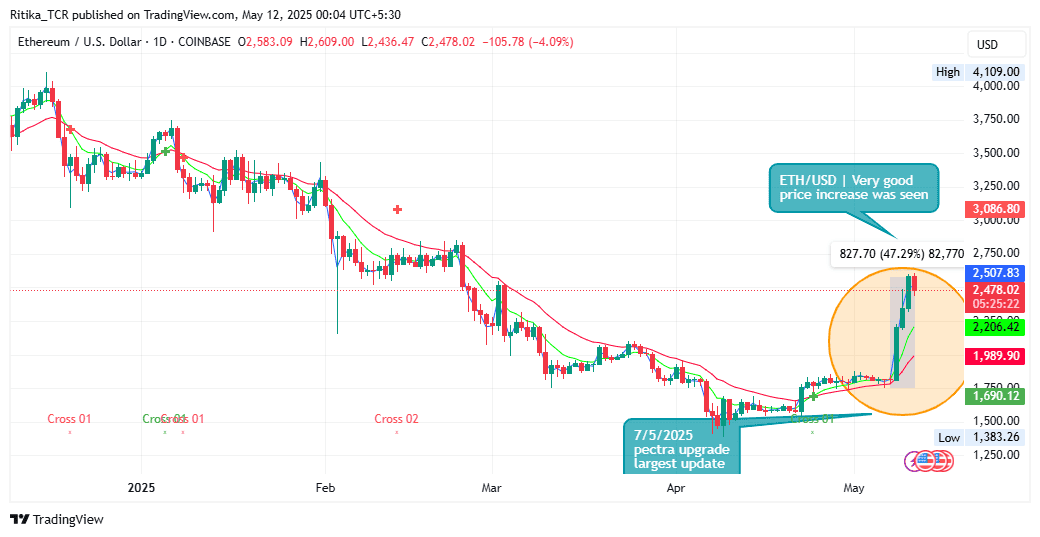

Fast forward to 7th May 2025. Ethereum launched Pectra, this is a dual upgrade combining Prague (execution layer) and Electra (consensus layer). While Cardano focused on governance, Ethereum tackled user experience, scalability, and gas fees.

The improvements were real:

Fewer clicks for on-chain actions

Smarter wallets

Cheaper transactions

Cleaner staking options

But unlike Cardano, Ethereum chose the perfect time.

The Trade Deal That Changed Everything

Just a day after Pectra went live, the U.S. and U.K. on May 8th announced a new trade deal. While not groundbreaking in terms of economics (UK only forms 3% of U.S. trade), it brought something markets crave: certainty.

The threat of 25% tariffs was off the table. This calmed markets, fueled optimism, and triggered FOMO across various assets that including ETH.

ETH/USD 1.D. | Source: TradingView

Ethereum's fundamentals aligned with favorable geopolitics. A recipe for success.

ETH surged 47%. ADA holders watched in disbelief.

What Made the Difference?

Many wondered: why such a massive contrast in reactions?

It boils down to timing and sentiment. Cardano's Plomin came during growing fear. Ethereum’s Pectra dropped when optimism returned.

In simpler words: ADA went against the wind. ETH rode the wave.

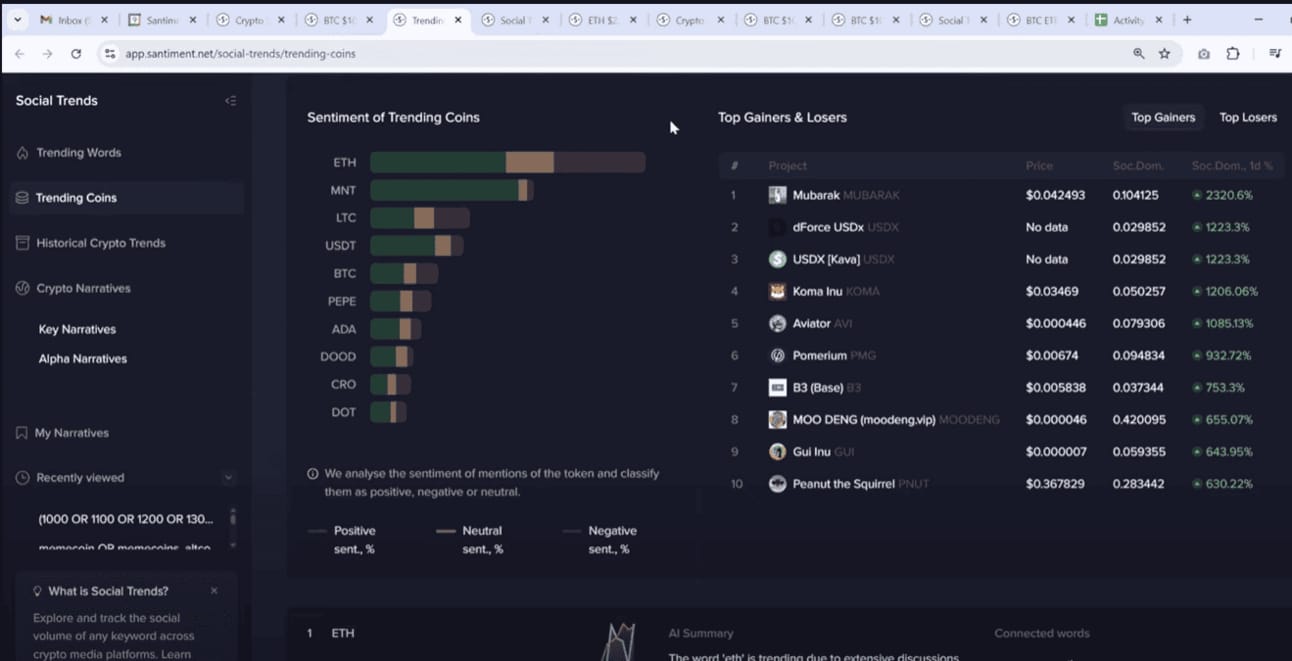

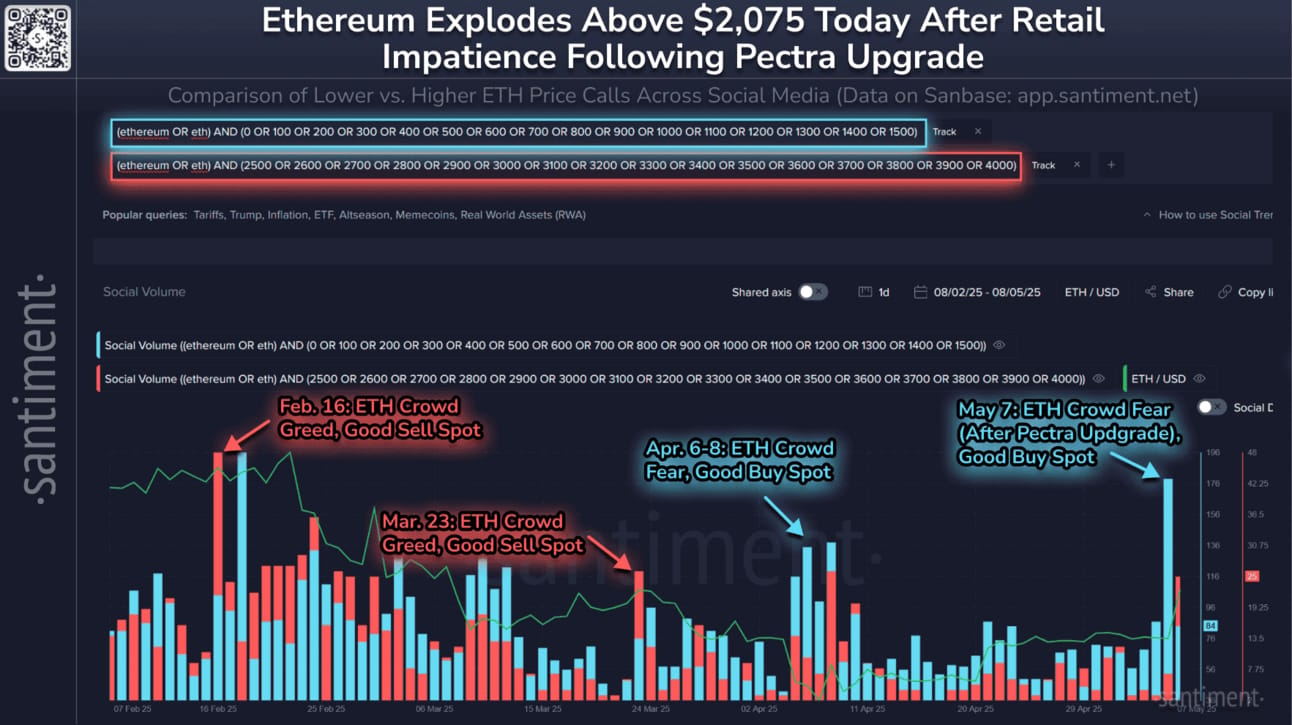

According to data from Santiment, Ethereum-related social media discussions spiked 44% post-Pectra.

The buzz wasn’t just hype, infact, it reflected real interest. Mixed views dominated:

50% positive

33% negative

17.5% neutral

Surprisingly, this mix is bullish. Why? Because it’s not saturated with euphoria, but its a sign the pump might still have legs.

Plus, many who had written ETH off over the past 2 to 3 years started buying back in and did FOMO buying. And this time, they were rewarded, who have been patient with the notoriously under-performing asset.

A Tale of Fundamentals - And Fortunes

Let’s be clear. Both Plomin and Pectra were landmark events:

Plomin decentralized Cardano's governance, which is an achievement that sets the stage for long-term resilience.

Pectra solved Ethereum’s pressing UX and scalability issues, which is a win for everyday users and developers.

But in crypto, perception and timing often overshadow substance. The markets didn’t reward ADA when they should have. ETH, on the other hand, hit the sweet spot.

Have you held ADA or ETH through these upgrades? Hit reply and tell us your experience. Did you buy the rumor, sell the news or hold strong?

Or, if you're watching from the sidelines, what would make you jump in now?

Run IRL ads as easily as PPC

AdQuick unlocks the benefits of Out Of Home (OOH) advertising in a way no one else has. Approaching the problem with eyes to performance, created for marketers with the engineering excellence you’ve come to expect for the internet.

Marketers agree OOH is one of the best ways for building brand awareness, reaching new customers, and reinforcing your brand message. It’s just been difficult to scale. But with AdQuick, you can plan, deploy and measure campaigns as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at AdQuick.com

What’s Next?

With the U.S.-UK trade deal setting the tone, other nations may soon follow. If more trade uncertainty eases, we could see broader risk-on sentiment return, potentially lifting altcoins still stuck in the mud.

ETH is now trading near $2,500. BTC has touched $104K. Altcoins are stirring.

The key lesson? In crypto, even the greatest update means little if the market isn’t ready.

So as developers build, we, as traders and investors, must watch the winds.

Until next time, stay sharp and stay curious.

Stay tuned, Hodler’s.

We’ll be tracking Q2 week by week - and as always, decoding the signal from the noise.

Until next time,

From FOMOchain Team.

Join 400,000+ executives and professionals who trust The AI Report for daily, practical AI updates.

Built for business—not engineers—this newsletter delivers expert prompts, real-world use cases, and decision-ready insights.

No hype. No jargon. Just results.

Social Sentiment and FOMO Fuel